Mutual Funds

What is Mutual Fund

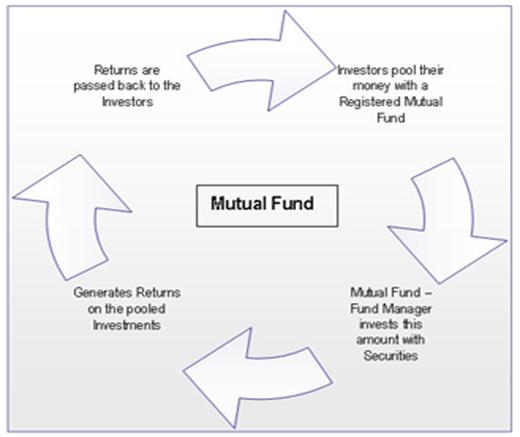

- A common pool of money into which investors place their contribution.

- This money is to be invested according to the objective of the fund.

- Ownership of the fund is joint or mutual among investors-according to their contribution.

- Ownership is through the holding of units respectively.

- This pooled income is professionally managed on behalf of the unit-holders, and each investor holds a proportion of the portfolio i.e. entitled not only to profits when the securities are sold, but also subject to any losses in value as well.

- For retail investor who does not have the time and expertise to

- analyze and invest in stocks and bonds, mutual funds offer A

- viable investment alternative. This is because:

- Mutual Funds provide the benefit of cheap access to expensive stocks.

- Mutual funds diversify the risk of the investor by investing in a basket of assets.

- A team of professional fund managers manages them with in-depth research inputs from investment analysts.

- Being institutions with good bargaining power in markets, mutual funds have access to crucial corporate information which individual investors cannot access.

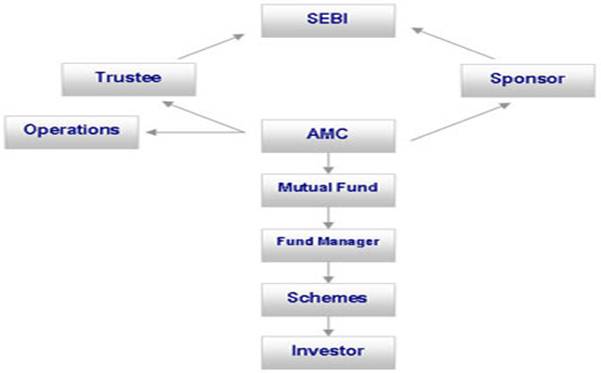

Entities Involved in Mutual Fund

The following diagram illustrates various entities involved in the organizational structure of Mutual Fund

Top ADVANTAGES OF MUTUAL FUNDS

- Professional Management

- Portfolio Diversification Across Companies & Sectors

- Reduction of Risk

- Low Cost of Operation Lower Transaction Cost

- Convenience & Flexibility

- Liquidity Entry & Exit at NAV

- Transparency Regular Disclosure

- SEBI is the regulatory authority of all Mutual Funds. SEBI has the following

- Broad guidelines pertaining to mutual Funds.

- Mutual Fund should be formed as a Trust under Indian Trust Act and should be operated by Asset Management Companies (AMCs).

- Mutual Fund needs to set up a Board of Trustees and Trustee Companies. They should also have their Board of Directors.

- The net worth of the AMCs should be at least Rs.5 crores.

- AMCs and Trustees of a Mutual Fund should be two separate and distinct legal entities.

- The AMC or any of its companies cannot act as managers for any other fund.

- AMCs have to get the approval of SEBI for its Articles and Memorandum of Association.

- All Mutual Funds’ schemes should be registered with SEBI.

- Mutual Funds should distribute minimum of 90% of their profits among the investors.

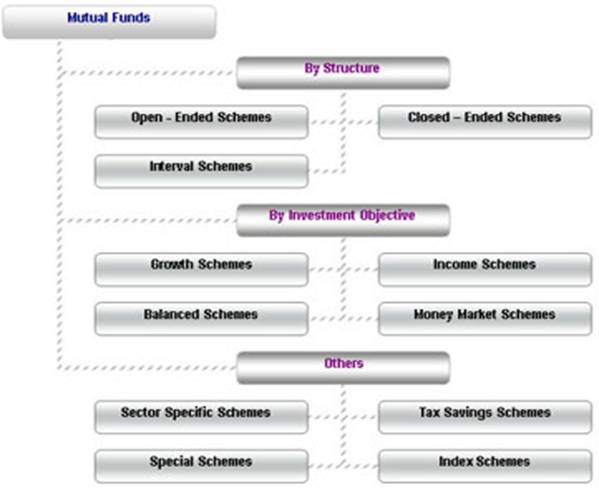

Types of Mutual Funds Schemes in India

Wide variety of Mutual Fund Schemes exists to cater to the needs such as financial position, risk tolerance and return expectations etc. thus mutual funds has Variety of flavors, Being a collection of many stocks, an investors can go for picking a mutual fund might be easy. There are over hundreds of mutual funds scheme to choose from. It is easier to think of mutual funds in categories, mentioned below.

Overview of existing schemes existed in mutual fund category: BY STRUCTURE

1. Open - Ended Schemes:

An open-end fund is one that is available for subscription all through the year. These do not have a fixed maturity. Investors can conveniently buy and sell units at Net Asset Value ("NAV") related prices. The key feature of open-end schemes is liquidity.

2. Close - Ended Schemes:

These schemes have a pre-specified maturity period. One can invest directly in the scheme at the time of the initial issue. Depending on the structure of the scheme there are two exit options available to an investor after the initial offer period closes. Investors can transact (buy or sell) the units of the scheme on the stock exchanges where they are listed. The market price at the stock exchanges could vary from the net asset value (NAV) of the scheme on account of demand and supply situation, expectations of unitholder and other market factors. Alternatively some close-ended schemes provide an additional option of selling the units directly to the Mutual Fund through periodic repurchase at the schemes NAV; however one cannot buy units and can only sell units during the liquidity window. SEBI Regulations ensure that at least one of the two exit routes is provided to the investor.

3. Interval Schemes:

Interval Schemes are that scheme, which combines the features of open-ended and close-ended schemes. The units may be traded on the stock exchange or may be open for sale or redemption during pre-determined intervals at NAV related prices.

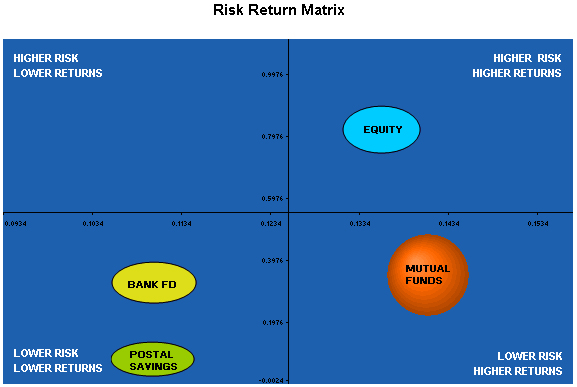

The risk return trade-off indicates that if investor is willing to take higher risk then correspondingly he can expect higher returns and vise versa if he pertains to lower risk instruments, which would be satisfied by lower returns. For example, if an investors opt for bank FD, which provide moderate return with minimal risk. But as he moves ahead to invest in capital protected funds and the profit-bonds that give out more return which is slightly higher as compared to the bank deposits but the risk involved also increases in the same proportion.

Thus investors choose mutual funds as their primary means of investing, as Mutual funds provide professional management, diversification, convenience and liquidity. That doesn’t mean mutual fund investments risk free. This is because the money that is pooled in are not invested only in debts funds which are less riskier but are also invested in the stock markets which involves a higher risk but can expect higher returns. Hedge fund involves a very high risk since it is mostly traded in the derivatives market which is considered very volatile.

Top Overview of existing schemes existed in mutual fund category: BY NATURE

1. Equity fund:

These funds invest a maximum part of their corpus into equities holdings. The structure of the fund may vary different for different schemes and the fund manager’s outlook on different stocks. The Equity Funds are sub-classified depending upon their investment objective, as follows:

- Diversified Equity Funds

- Mid-Cap Funds

- Sector Specific Funds

- Tax Savings Funds (ELSS)

2. Debt funds:

The objective of these Funds is to invest in debt papers. Government authorities, private companies, banks and financial institutions are some of the major issuers of debt papers. By investing in debt instruments, these funds ensure low risk and provide stable income to the investors. Debt funds are further classified as:

Gilt Funds: Invest their corpus in securities issued by Government, popularly known as Government of India debt papers. These Funds carry zero Default risk but are associated with Interest Rate risk. These schemes are safer as they invest in papers backed by Government.

Gilt Funds at a glance

- Gilts are government securities.

- Maturity - Medium to long term.

- Typically of over one year (less than one-year instruments are the money market securities).

- Gilts invest in government paper called dated securities (unlike treasury bills that mature in less than one year).

- Issuers – Government of India or State Government.

- Risk – Little risk of default, offer better protection of capital.

- Gilt securities face interest rate risk, like other debt securities.

- Debt securities prices is having inverse relation with Interest Rates.

- Income Funds: Invest a major portion into various debt instruments such as bonds, corporate debentures and Government securities.

- MIPs: Invests maximum of their total corpus in debt instruments while they take minimum exposure in equities. It gets benefit of both equity and debt market. These scheme ranks slightly high on the risk-return matrix when compared with other debt schemes.

- Short Term Plans (STPs): Meant for investment horizon for three to six months. These funds primarily invest in short term papers like Certificate of Deposits (CDs) and Commercial Papers (CPs). Some portion of the corpus is also invested in corporate debentures.

- Liquid Funds: Also known as Money Market Schemes, These funds provides easy liquidity and preservation of capital. These schemes invest in short-term instruments like Treasury Bills, inter-bank call money market, CPs and CDs. These funds are meant for short-term cash management of corporate houses and are meant for an investment horizon of 1day to 3 months. These schemes rank low on risk-return matrix and are considered to be the safest amongst all categories of mutual funds.

As the name suggest they, are a mix of both equity and debt funds. They invest in both equities and fixed income securities, which are in line with pre-defined investment objective of the scheme. These schemes aim to provide investors with the best of both the worlds. Equity part provides growth and the debt part provides stability in returns.

Further the mutual funds can be broadly classified on the basis of investment parameter viz,

Each category of funds is backed by an investment philosophy, which is pre-defined in the objectives of the fund. The investor can align his own investment needs with the funds objective and invest accordingly.

By investment objective:

• Growth Schemes: Growth Schemes are also known as equity schemes. The aim of these schemes is to provide capital appreciation over medium to long term. These schemes normally invest a major part of their fund in equities and are willing to bear short-term decline in value for possible future appreciation.

• Income Schemes:Income Schemes are also known as debt schemes. The aim of these schemes is to provide regular and steady income to investors. These schemes generally invest in fixed income securities such as bonds and corporate debentures. Capital appreciation in such schemes may be limited.

• Balanced Schemes: Balanced Schemes aim to provide both growth and income by periodically distributing a part of the income and capital gains they earn. These schemes invest in both shares and fixed income securities, in the proportion indicated in their offer documents (normally 50:50).

• Money Market Schemes: Money Market Schemes aim to provide easy liquidity, preservation of capital and moderate income. These schemes generally invest in safer, short-term instruments, such as treasury bills, certificates of deposit, commercial paper and inter-bank call money.

Other schemes

• Tax Saving Schemes:

Tax-saving schemes offer tax rebates to the investors under tax laws prescribed from time to time. Under Sec.88 of the Income Tax Act, contributions made to any Equity Linked Savings Scheme (ELSS) are eligible for rebate.

• Index Schemes:

Index schemes attempt to replicate the performance of a particular index such as the BSE Sensex or the NSE 50. The portfolio of these schemes will consist of only those stocks that constitute the index. The percentage of each stock to the total holding will be identical to the stocks index weightage. And hence, the returns from such schemes would be more or less equivalent to those of the Index.

• Sector Specific Schemes:

These are the funds/schemes which invest in the securities of only those sectors or industries as specified in the offer documents. e.g. Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are more risky compared to diversified funds. Investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time.

Concept of an Exchange Traded Fund (ETF)

- ETF is a mutual fund scheme, which combines the best features of open end and close end funds.

- ETF’s track the market index & trades like a single stock on the Stock Exchange.

- Its pricing is linked to the index and units can be bought/sold on the Stock Exchange.

- ETF offers investors the benefit of diversification and cost efficiency of an index.

• Just like Bank Fixed Deposits, FTPs are investments that run for a pre-determined time period. These are mutual funds that invest in bonds

• issued by the Govt. of India or reputed companies with strong ratings.

FTPs provide the following benefits over Fixed Deposits:-

- Higher Rate of Return compare to FD.

- FTPs are tax efficient -- investors pay a maximum of 22.66% Tax.

- Predictable returns with low risk.

- Easy Liquidity -- should you require to redeem your investment any time before the maturity period, you may do so by paying the applicable Exit Load similar to the Fixed Deposit.

And here's my elevator explanation:

Shares(equity): When companies look for money for their business, they can get it in two ways - either they borrow from a bank and pay interest ("debt") or they ask people like you and me to invest and give us shares ("equity"). A share is a part of a business.

Then let's say a friend named ANUPAM wants to buy a share of this business but the company has got all the money it needs. So ANUPAM asks us to sell our shares to him, at a higher value than we bought it. So he will own our share of the company, but he's willing to pay more because he thinks the company will do well. Now we make a profit and then ANUPAM perhaps sells it to someone else at even higher values etc. The company doesn't really get affected because it isn't seeing the money, but the share price goes up as the company starts doing better, and as more people begin to want the shares.

Why does the share price go up?

The answer is: Perceived value. I may think the company is worth 1 crore, but someone else might think it's worth 2 crores. When my shares reach my valuation I sell, but someone else will think it's a good deal and buy.

To organise such buying and selling, there are commercial "stock exchanges". BSE and NSE are some of them, though there are a number of other, smaller exchanges in India. An exchange provides a common place for people to buy or sell shares, with sales happening on an auction basis - buyers bid for shares at a price they are willing to pay, and sellers "ask" for a price from buyers. Exchanges match these prices and share exchanges happen along with payments. "Brokers" facilitate these exchanges, and you pay them a fee as brokerage, part of which goes to the stock exchange as well.

Mutual funds: When a lot of shares are available on stock exchanges, you and me don't know which companies to invest in. But let us say a guy named FUND MANAGER knows, and keeps track of the market daily. So we give him our money and he buys and sells stocks for us. This is a mutual fund - it's our money (mutual), and a Fund Manager. There is a structure to this in India, so a fund manager is part of an "asset management company (AMC)". To protect FUND MANGER from running away with our money, SEBI has some rules in place, and there are "trustees" for every fund. With this structure the AMC issues "units" to us for the money we have invested, and tells us how much our units are worth daily (NAV). We can then choose to exit by selling our units back to the AMC ("redemption").

Top Mutual funds are not just restricted to shares. They are mutual investments, therefore they can be anywhere. The common ones are equity (stocks and shares) and Debt. Debt markets are where companies borrow money, but they want to borrow huge sums of money that you and I don't have. Therefore, we pool in our money (mutual fund) and give the big whole lot to the company at an interest. Even the government borrows, but again, only large sums of money. Mutual funds can invest there too. Debt is traditionally "safer" than equity since there is a fixed valuation and good rating mechanisms to curb risk; and in the same vein, the profits (and losses) are usually much lesser than equity.

Mutual funds can also invest in other investment avenues, like Gold, Real Estate, Commodities and even in Windmills! Of course, in India only a few of these are available. Shares are a part of a business, mutual funds are cumulative investment.

FREQUENTLY USED TERMS

• Net Asset Value (NAV)

Net Asset Value is the market value of the assets of the scheme minus its liabilities. The per unit NAV is the net asset value of the scheme divided by the number of units outstanding on the Valuation Date.

• Sale Price

Is the price you pay when you invest in a scheme. Also called Offer Price. It may include a sales load.

• Repurchase Price

Is the price at which units under open-ended schemes are repurchased by the Mutual Fund. Such prices are NAV related.

• Redemption Price

Is the price at which close-ended schemes redeem their units on maturity. Such prices are NAV related.

• Sales Load

Is a charge collected by a scheme when it sells the units. Also called, ‘Front-end’ load. Schemes that do not charge a load are called ‘No Load’ schemes.

Repurchase or ‘Back-end’Load Is a charge collected by a scheme when it buys back the units from the unitholders

SIP-Invest Smart, Invest Safe

Systematic Investment Plan (SIP)

• Spreads investment over the duration of SIP in small, manageable installments

• Constant presence makes sure you don’t miss out on any opportunities

Benefits of SIP

- Gives you a lower unit cost than the market average

- It is a dynamic way to invest in fluctuating markets

- Compounding gives you greater advantage

- Additional Benefits

- Dividends are tax free*

- Your portfolio is managed by expert fund managers

- Gives you complete transparency by way of disclosure of portfolio every month

- You earn regularly,

- You spend regularly,

HOW DOES ITS WORK?

- Rupee Cost Averaging

- Rupee cost averaging – generally gives

- you a lower unit cost than market average

- Investing fixed amounts makes sure you

- purchase more units at a lower price and

- less at a higher price

Illustration - Rupee Cost Averaging

Say you have opted for Reliance Systematic Investment Plan, investing Rs. 1000 every month from March 2009 to Feb 2010 in a diversified equity fund. Now check the average purchase cost per unit of your investments. It would be lower than the average NAV of your investment over 12 months.

Date |

NAV (Rs.) |

Units |

Amount (Rs.) |

2/03/09 |

190.47 |

5.25 |

1000.00 |

13/04/09 |

233.32 |

4.29 |

1000.00 |

11/05/09 |

252.50 |

3.96 |

1000.00 |

10/06/09 |

339.27 |

2.95 |

1000.00 |

10/07/09 |

307.21 |

3.26 |

1000.00 |

10/08/09 |

343.02 |

2.92 |

1000.00 |

10/09/09 |

375.56 |

2.66 |

1000.00 |

12/10/09 |

392.46 |

2.55 |

1000.00 |

10/11/09 |

392.76 |

2.55 |

1000.00 |

10/12/09 |

416.48 |

2.40 |

1000.00 |

11/01/10 |

439.79 |

2.27 |

1000.00 |

10/02/10 |

412.21 |

2.43 |

1000.00 |

Total |

4095.04 |

37.47 |

12000.00 |

Average Cost = Total Cash Outflow / Total Number of units = Rs. 12000/ 37.47 = Rs. 320.24 Average Price = sum of all NAVs at which you have invested/Number of months of investment = Rs. 4095.04/12 = Rs. 341.25 Average Cost < Average Price

Note: The above table considers the actual NAV of Reliance Growth Fund to explain the concept of Rupee Cost Averaging. The NAV do not in any manner indicate the future NAVs of the any of the schemes of Reliance Mutual Fund. Past performance may or may not be sustained in future

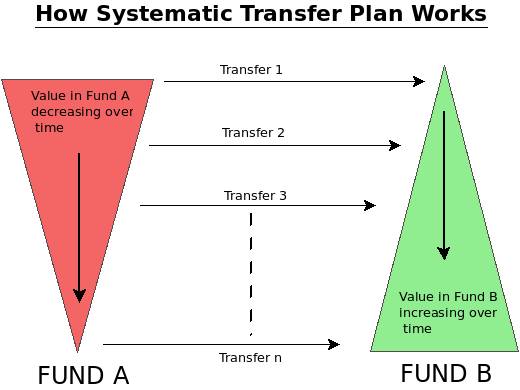

What is Systematic Transfer Plan (STP)

Imagine a scenario when you want to invest a big lump sum amount in stock market ? As markets are volatile and can go up or down very soon , there is always risk of loosing a big chunk of your investment (Learn about Stock Markets) . Take a case where you want to invest 10 lacs in Equity Mutual funds and suddenly market crashes for next 2 months, In this case a big chunk of your investment will be lost, on the other hand if market moves up pretty fast, you can make a good profit. Here you have to decide your main focus. If it’s minimizing risk and getting good decent returns in long-term, You should use something called Systematic Transfer Plan (STP) .

Top What is STP (Systematic Transfer Plan)

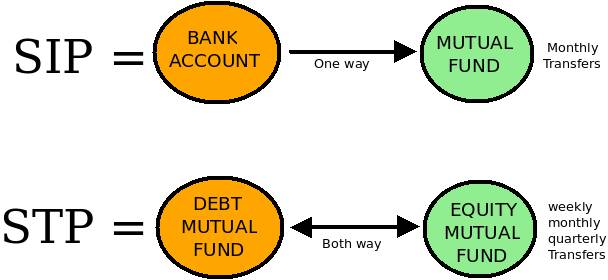

You should first understand SIP . SIP is way of investing in Mutual funds monthly, where a fixed amount of money goes from your Bank Account to Mutual funds, so if you do a SIP of 1,000 for 1 yr, it means that every month on a fixed date (chosen by you) 1,000 will be invested in a Fixed Mutual fund you choose. Lets understand STP now, In STP we invest a lump sum amount in some Mutual Fund and then a fixed sum is transferred from that mutual fund to another mutual fund .

For Example : If you have Rs 6 lacs lump sum to invest and you want to invest in HDFC Top 200 , The steps you will have to follow are :

1. Choose a good Debt fund or Floating Rate Mutual Fund from HDFC , which allows STP to HDFC Top 200 .

2. Invest all the money in the Debt Fund .

3. Now you can start a 10k/20k/30k per month STP from HDFC Debt fund to HDFC Top 200 .

Why and When to use STP

When will it work : STP will make sense from DEBT -> EQUITY when markets are mayvery volatile and you dont want to take risk with your money in a short span of time, If you invest through STP in markets and markets fall or have lots of volatile moves, then this situation will be better than the one time investment option. This is still better than putting money in Bank and doing a SIP, because at least you money is earning some returns on debt part in STP .

When will it not work : Incase markets are already at the end of a Bear market and markets can starts it upmove anytime, in that case STP will not deliver the best returns like SIP, one time investment is a good choice in that case. But then you never know that when will markets start go up. Given that a retail investor does not have all the tools and time to research the markets, it’s not advisable to invest lump sum in any case. It’s better to get 4-5% less returns than to see a huge downside of your money in short time, Smart investors think about returns, Smartest one’s take care of risk first .

Understand How to time markets using Nifty PE analysis

Difference between SIP, STP and SWP

• SIP : The way SIP works that your money is in your Bank Account and every month a fixed sum is taken away from your Bank and invested in a Mutual fund .

• STP : The way STP works is, all your money is actually invested in a Mutual funds itself (probably Debt) and units are sold every month and its invested in another Mutual fund (probably Equity) or vice versa .

• SWP : However If you redeem your units in mutual funds every month and get it deposited in your Bank accounts , it’s called SWP (systematic Withdrawal Plan) , which is recommended to liquidate your mutual funds corpus after you see a good bull market to protect your investment .

4 advantages of STP

STP has 4 advantages and works in 4 ways for you . They are :

Works as SIP : You can invest in a Debt funds and from there you can start a STP to an Equity Fund , so it works like a systematic Investment Plan (SIP) .

Works as SWP : So STP can also work like SWP, because with some funds you can do transfer from Equity funds to Debt Funds, so when markets look risky to you, you can start a STP from Equity -> Debt funds, which will act like SWP .

Liquidity : Generally one does STP from Debt -> Equity funds, so your money is invested in Debt fund. This means you can sell it anytime if you want. Hence it works like a Emergency Fund also. Incase you need money urgently, it can act like a liquid asset (at least for the time being in the start when you have more money in Debt fund)

Growth in Money : Not to forget that your money is invested in Debt funds, so your money is also growing at debt returns , at least the part which is lying in the debt funds .

Some Helpful Tips

• Invest in ELSS , If you want to invest in ELSS schemes and have lump sum money , better put it in a debt funds and do a STP .

• Rebalance your portfolio, Use STP as a tool to rebalance your asset allocation, when your equity part goes up , start STP from Equity-Debt for 6 months or 1 yr, and bump up your debt part and if your Debt part goes up, do Debt -> Equity STP . Power of Asset Allocation and Portfolio Rebalancing

• Take advantage of market condition , If markets have gone too high now and every other person on the road is talking about Stock and stock markets are more famous than “Saas Bahu” Serials, immediately start your STP from Equity to Debt (literally Rush) . On the other hand when markets are deep down and “Why don’t you buy stocks” is feels abusive and everyone face looks like some body has died at home when you mentions stock markets, know that it’s a time to start a STP from your Debt – > Equity (Literally rush again) . You don’t need to see any indicators to predict the markets, the two real life scenarios I have described here are enough, try to remember markets around 2007 End(bull market) and Jan 2009 (markets lowest point) . STP can be used as switching mechanism in ULIP , though it’s very restrictive and with less choices .

• Using STP when an important goal is near, If you are saving for some important goal like Child Education , Buying Home or Retirement and your goal is approaching near by , don’t wait till target date , you don’t want to see your Money dip by 40-50% within 6 months or so if markets suddenly crash , start moving your money out of equity and transfer it to Debt now through STP .

Two types of STP

There are two types of STP plans , Fixed and Capital Appreciation. In Fixed Plan means a fixed sum will be transfered to the target mutual funds , on the other hand in Capital Appreciation , only the amount of capital which is appreciated gets transferred , that was the original lumpsum amount invested in the start is protected . Capital Appreciation choice is only with Growth Plan and not dividend plan . Here is the list of all the STP Plans as of now .

STP Information

View more presentations from The Financial Literates.

Important Points

- Typically, a minimum of six such transfers are to be agreed on by investors in STP , just like SIP

- Generally most of the mutual funds allow Debt -> Equity STP and not reverse , Only handful of Mutual Funds like Kotak allows it .

- STP is a facility for convenience , when the transfer happens from one mutual funds to another its still considered as selling of mutual funds and then buying another one , so tax rules applies in the same way .

- Most of the funds allow only Monthly and Quarterly STP , some allow weekly and fortnightly also .

- There can be some minimum amount requirement for starting an STP like say at least 1,00,000 needs to be invested in Debt funds to start a STP to Equity . Some restriction like this will be there .

- There can be additional Switching Charges for availing STP facility

- Entry load and Entry load may still apply while buying and selling of mutual funds through STP.

- Securities Transaction Tax @ 0.25% will be deducted on equity oriented funds at the time of redemption or switch to another scheme in STP .

Tax rates as per Finance Act 2013

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Deducted at Source (Applicable only to NRI Investors) |

||

|

Short term capital gains |

Long term capital gains |

Equity oriented schemes |

15% |

NIL |

Other than equity oriented schemes |

30% |

20% (@@) |

Income Tax Rates |

||||||||||

For Individuals, Hindu Undivided Families, Association of Persons and Body of Individuals |

||||||||||

|

(a) In the case of a resident individual of the age of sixty years or above but less than eighty years, the basic exemption limit is Rs. 250,000

(b) In the case of a resident individual of the age of eighty years or above, the basic exemption limit is Rs 500,000

(c) Surcharge @10% is applicable on income exceeding Rs 1 crore, marginal relief for such person is available

(d) Surcharge is not applicable, Education Cess of 3% on income-tax is levied

(e) As per Finance Bill 2013 a rebate of Rs 2000 is allowed for individual having income up to Rs 5 Lacs

Top